Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.

Key Takeaways

- Bonuses and student loan assistance improve workplace wellness. Combine the two to double down on employee satisfaction and loyalty.

- 100% of student loan assistance bonuses go toward knocking down debt. Give employees one less thing to worry about this holiday season.

- Section 127 plans make contributions tax-free! Both you and your employee will get more bang for your buck.

- Paidly’s on-demand payments make depositing effortless. With our simple sign-up and easy-to-use platform, you’ll be ready to send bonuses in no time.

Year-end bonuses boost employee wellbeing both on and off the job. Why not offer a bonus that will truly make a difference?

With the CARES Act 2.0, you can put employee bonuses directly toward their student loans, saving them time and money for years to come. As if that weren’t reason enough, it gets better: contributing to employee student loans under a Section 127 plan makes it tax-free all around.

Need help creating a Section 127 plan? Paidly's experts can guide you through the process and help you implement a compliant and effective educational assistance program. Talk to an Expert today to learn more.

Let’s dive into why giving student loan assistance bonuses is a smart move for you and your employees.

Bonuses boost employee morale at work

Giving bonuses builds employee loyalty and renews workplace motivation. When employees feel valued and supported, they’re happier, more productive, and less likely to pursue other employers.

A study by Harvard Business Review found performance-related bonuses increased job satisfaction, employee commitment, and trust in management. Now add in that 86% of employees would commit at least five years to a company if they received student loan assistance. By giving a student loan assistance year-end bonus, you’re not only fostering employee loyalty but also making a true impact in their lives.

Extra financial support relieves stress at home

The holiday season often brings higher expenses for many with increased travel and gift-buying. A year-end bonus can help your employees enjoy this time with a lighter financial load, and putting that bonus toward their student loans takes a major stressor off their plate. Plus, it’s the gift that keeps on giving: even a small amount toward student loans can save your employee years of repayment.

Contributions toward student loans can be tax-free

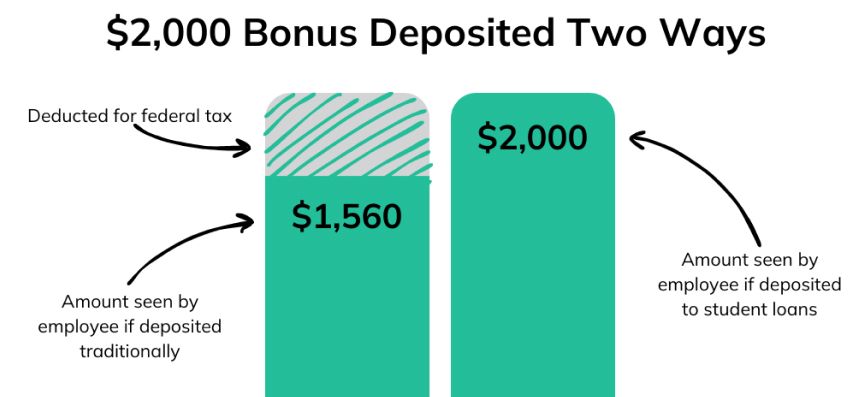

Depositing bonuses into student loans is tax-free for both you and your employee when you have a Section 127 plan. That’s a huge deal when standard bonuses are considered supplemental income and get taxed 22% (or more!) federally. Don’t have a Section 127 plan? You can still put bonuses toward student loans, the contribution will just be taxable as income at the end of the year.

With or without a Section 127 plan, putting employee bonuses directly toward their student loans means knocking off substantially more debt than if deposited into their bank account.

Let’s say you plan to give a year-end bonus of $2,000. If paid out traditionally, the most your employee will see is $1,560 - and that’s without deducting state taxes. However, when deposited to their student loans, your employee’s debt decreases by the full $2,000, giving you both more bang for your buck.

Maximize your holiday bonuses with Paidly

Paying bonuses directly toward student loans this holiday season is a win for everyone involved. Not sure how to get started? No worries! Paidly makes it easy.

Paidly’s on-demand supplemental student loan repayment service lets you help employees tackle student loan debt without committing to regular monthly payments. You choose when to contribute and we handle the rest. Plus, signing up is easy - just a few quick steps and you’ll be ready to help employees gain financial freedom.

With on-demand payments, you’ll get to test drive what makes Paidly so special (like how we deposit payments quickly, provide an easy-to-use platform, and maintain employer-employee confidentiality) before deciding whether to add student loan assistance to your employee benefits.

Already making recurring student loan payments? With Paidly, you can give your employees an extra financial boost with on-demand bonuses, no extra set-up necessary.

Budget tight this year? Learn how you can convert unused employee PTO into a tax-free bonus.

Want to know more about how Paidly can support your workforce? Schedule a demo or send us an email at [email protected].

Samantha Park

Samantha Park is a writer with a background in public service work. She recently earned a M.S. in Professional Writing from Towson University where she focused on writing for the private and public sectors, and has previously graduated with an A.A. in Psychology from Anne Arundel Community College and a B.A. in Sociology from the University of Maryland College Park. Samantha has worked within and alongside the public sector for the past decade and cares deeply about empowering marginalized youth, expanding access to opportunity through education, and increasing community involvement.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

529 to Roth IRA Rollovers: A New Path to Retirement Savings

529 plans got a retirement upgrade! Roll over funds to a Roth IRA tax-free.