Understanding Section 127 Plans: Your Guide to Making Smart Tax Choices

Because every penny counts when you're paying back student loans.

Key Takeaways

- Section 127 of the tax code provides opportunities for both employers and employees.

- How to create a Section 127 plan and its requirements.

- Higher earners, known as "Highly Compensated Employees," may face restrictions within Section 127 plans, but solutions exist.

- Paidly helps employers seamlessly incorporate Section 127 benefits into payroll operations

What is the Section 127 Plan?

A Section 127 Plan is an official document outlining a company's Educational Assistance Program (EAP). It allows employers to provide up to $5,250 per year in tax-free benefits to support employees' educational expenses or student loan repayments.

How to create a section 127 plan

Creating a Section 127 plan allows employers to offer valuable educational benefits to their employees. Follow these steps to establish a compliant and effective plan:

-

Select Educational Benefits: Choose the educational assistance you want to provide, such as tuition reimbursement for degree programs, professional development courses, or student loan repayment assistance.

-

Allocate Funds: Determine the amount of money your organization will allocate to the Section 127 plan. Remember, you can provide up to $5,250 per employee annually in tax-free educational assistance.

-

Establish Eligibility Requirements: Define clear eligibility criteria for employees to participate in the plan. Consider factors such as employment status, length of service, and performance metrics.

-

Ensure Compliance: Review the legal requirements for Section 127 plans, including non-discrimination rules and reporting obligations. Consult with legal and tax professionals to ensure your plan complies with all applicable regulations.

-

Prepare Written Documentation: Draft a formal written plan document that outlines the details of your Section 127 plan, including eligibility requirements, covered expenses, and procedures for requesting and receiving benefits.

Need help creating a Section 127 plan? Paidly's experts can guide you through the process and help you implement a compliant, effective educational assistance program. Talk to an Expert today to learn more.

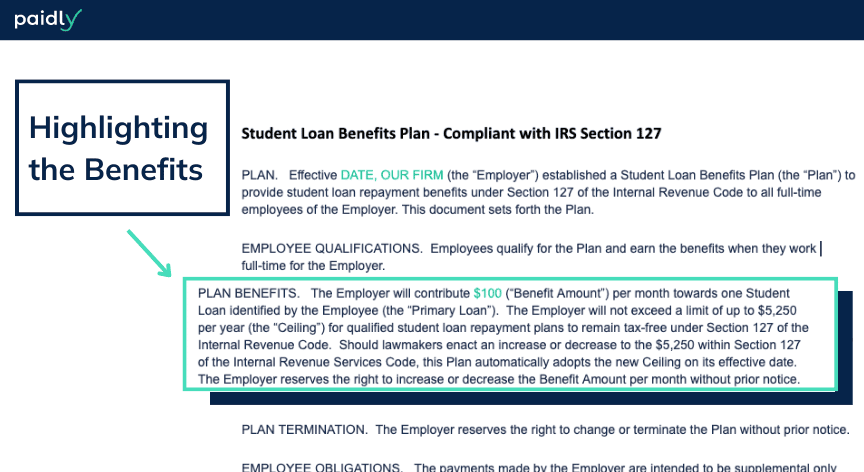

Sample of a Section 127 Plan:

Tax Benefits of a Section 127 plan and Eligibility

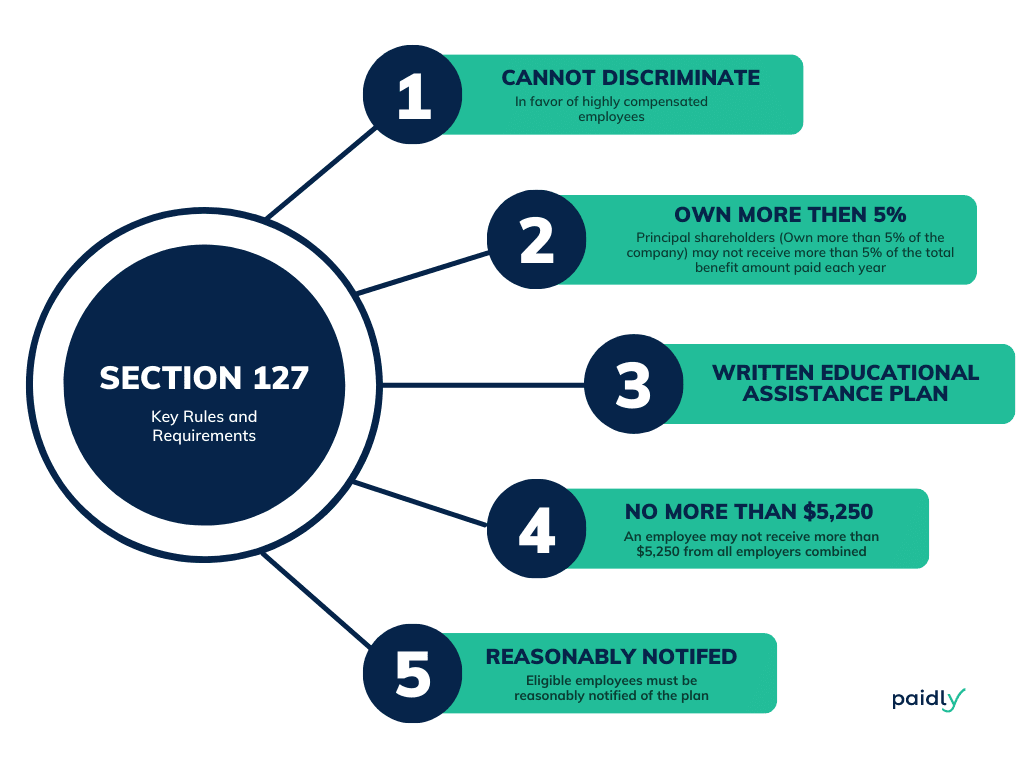

Under Section 127, employer contributions towards an employee's student loans or educational expenses are tax-free up to $5,250 per year. To maintain eligibility, the plan must:

- Be documented in writing.

- Not show preferential treatment to highly compensated employees.

- Exclude employees with more than 5% ownership in the company.

- Properly inform all eligible employees about the plan's availability.

The Rules around Section 127 Plans

This provision allows employers to help their employees without facing tax liabilities. To reiterate, the plan should be in writing, provide reasonable notification of availability and its terms to eligible employees, and not provide more than 5% of its payments to shareholders, owners, or their dependents.

To comply with the IRS, verify that your Section 127 plan lets an appropriate segment of the workforce reap the rewards.

Highly Compensated Employees and Eligible Employees?

In IRS terms, a "Highly Compensated Employees (HCEs)" are individuals who either:

- Owned more than 5% of the business in the current or previous year.

- Earned a substantial amount from the business in the previous year (e.g., over $150,000 in 2023).

- If the employer decides, the person could also be in the top fifth (or 20%) of all employees ranked by how much they're paid.

The program should not disproportionately benefit HCEs. Eligible employees include current employees, retirees, and those who lost their jobs or cannot work due to disabilities.

What is the IRS Section 127 Limit?

Section 127 of the Internal Revenue Code limit is only a tax-free limit of $5,250 annually. Employers can contribute more to their employees, but will be required to pay taxes beyond the tax-free limit.

Helping Employers Implement Section 127 Plans

Paidly assists employers in seamlessly incorporating Section 127 benefits into their payroll operations. By allowing employers to make supplemental payments to employees' student loans, Paidly helps businesses leverage Section 127 to benefit both the company and its employees.

To learn more about how Paidly can help your organization implement a Section 127 plan, reach out to Talk to one of our experts today.

Team Paidly

Paidly is a Student Loan Repayment Benefit platform. Leveraging over a decade and a half of Fintech, student loan origination, and refinancing experience. Paidly specializes in creating custom student loan repayment benefit plans, designed specifically to allow employers to pay directly towards their employees' student loans. Paidly's system requires no integration and enhances talent attraction and employee retention.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.