The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

Key Takeaways

- 529 plans are educational savings that grow tax-deferred. Funds can be used on various education-related expenses from K-12 through higher education.

- Savings set up younger generations for success. Children with education funds are more likely to go to college and graduate than those without.

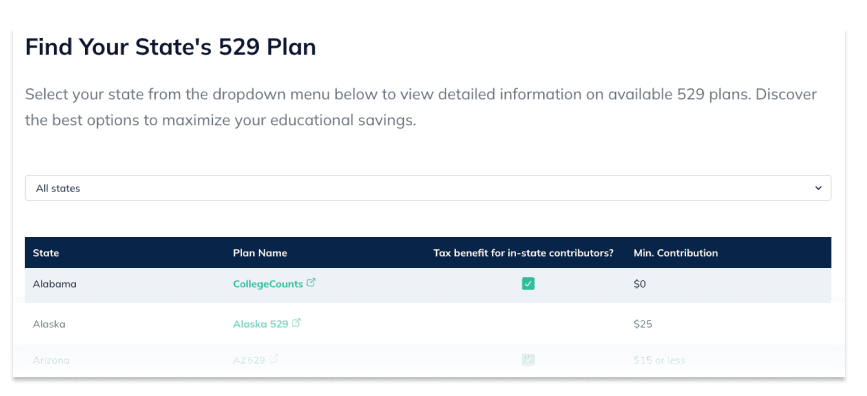

- Some states offer tax-benefits for contributors. Use Paidly’s Find Your State’s 529 Plan tool to see whether you could benefit.

It’s no secret that giving bonuses improves employee wellbeing and strengthens your workforce. Make your year-end bonuses go further this season by putting them toward 529 educational savings plans.

Where you deposit a bonus can make a big difference

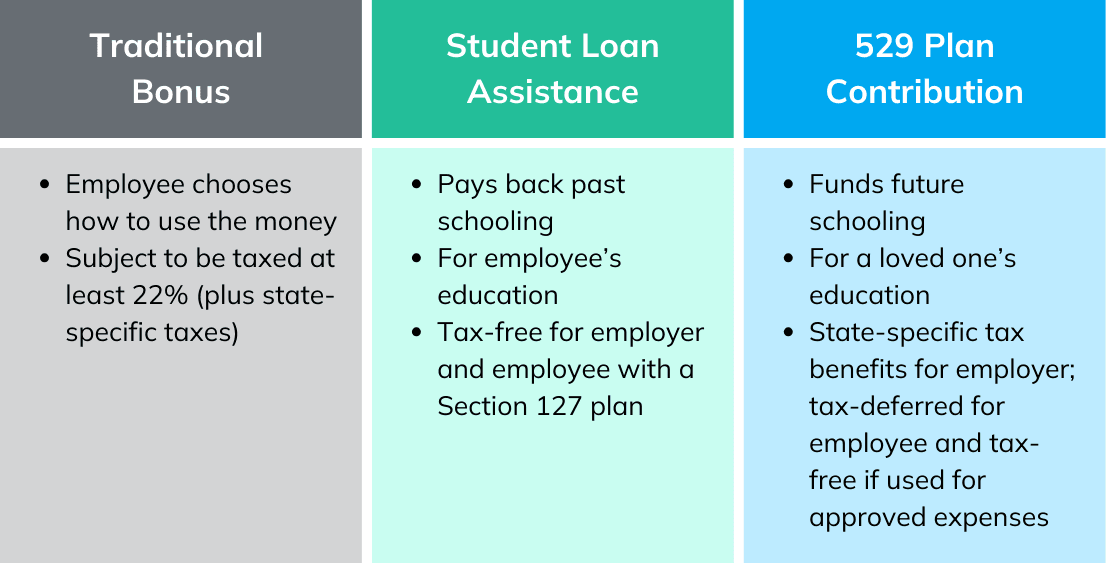

There are pros and cons wherever you put an employee’s bonus. Here are some things to keep in mind as you pay out bonuses this year:

Traditional Bonus A traditionally deposited bonus gives employees freedom regarding how to spend the money, but a good chunk of it will be eaten by federal and state taxes.

Student Loan Repayment Assistance A tax-free option is to put that money toward student loans with a Section 127 plan, which helps employees knock off debt using the full amount of the bonus. They’ll still benefit from the full amount without a Section 127 plan, but both employer and employee will be subject to tax at the end of the year.

529 Plan Contribution For employees that don’t have student loan debt, contributions to 529 plans are a great option to help minimize future educational debt for their loved one, though tax-benefits vary by state.

In our last post, we covered why putting year-end bonuses toward employee student loans is a smart move. Now, let’s get into how a 529 contribution will make your bonus felt for years to come.

529 plans relieve financial strain for generations

Many families struggle to keep up with the rising cost of education, pushing them to take out student loans. Though helpful and often essential, student loan debt can have lifelong consequences like delaying major milestones (such as parenthood and homeownership), affecting credit scores and credit limits, and hindering the ability to build wealth.

529 plans help minimize or eliminate the need to take out student loans. 529 plans are educational savings accounts for beneficiaries to use on various education-related expenses. They build savings for future use and can help pay for K-12 schooling, college tuition, on-campus room and board, apprenticeship programs, and educational supplies.

When the average college student pays 50% of college costs out of pocket, every little bit counts. Contributing to 529 plans sets up the next generation for financial freedom before they hit adulthood.

Educational savings support the future workforce

529 plan contributions have far-reaching and lasting impacts on beneficiaries (these are your employee’s kids, grandkids, or other loved ones). Helping to fund their future education means peace of mind for your employee while setting up their loved one for academic and career success.

A series of studies by the Washington University Center for Social Development found that children with educational savings were six times more likely to attend college than those without college funds. Having even $1 saved made children more likely to pursue higher education and more likely to graduate.

With 72% of jobs projected to require higher education by 2031, it’s more important than ever to prepare families for incoming educational expenses. Putting a year-end bonus toward a 529 plan is a great way to start or add to your employee’s nest egg this holiday season.

Some states offer tax-benefits on 529 contributions

Funds in 529 plans are tax-deferred until withdrawn, and as long as those funds go toward qualified educational expenses, they’re tax-free for the beneficiary.

While not tax-free for employers like student loan assistance bonuses, some states offer tax incentives for 529 contributions. We recommend consulting with a tax expert to see what contributing to 529 plans could mean for you.

Learn more about your state’s 529 plan and tax benefits with Paidly’s Find Your State’s 529 Plan tool.

Make 529 contributions stress-free with Paidly

Navigating 529 plans and figuring out how to pay toward them can be time-consuming. Let Paidly do the work for you.

With Paidly’s on-demand payments, you can put bonuses straight into your employee’s educational savings plans, no hassle and no commitment. Our simple sign-up and easy-to-use platform means you’ll be sending bonuses in no time.

See how easy 529 contributions can be by visiting our 529 employer benefit page.

Not sure whether to offer student loan assistance or 529 contributions? Why not both!

With Paidly, you don’t have to choose which educational benefits to offer. Personalize your employee’s bonus to aid them where they need it most. Whether helping a recent graduate pay off their debt or investing in a long-time employee’s children, Paidly empowers you to make year-end bonuses more meaningful this holiday season.

- Already making recurring contributions or providing student loan assistance? With Paidly, you can give your employees an extra financial boost with on-demand bonuses to 529 plans and student loan repayment, no extra set-up necessary.

To learn more about how Paidly can support your workforce, schedule a demo or send us an email at [email protected].

Samantha Park

Samantha Park is a writer with a background in public service work. She recently earned a M.S. in Professional Writing from Towson University where she focused on writing for the private and public sectors, and has previously graduated with an A.A. in Psychology from Anne Arundel Community College and a B.A. in Sociology from the University of Maryland College Park. Samantha has worked within and alongside the public sector for the past decade and cares deeply about empowering marginalized youth, expanding access to opportunity through education, and increasing community involvement.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.

529 to Roth IRA Rollovers: A New Path to Retirement Savings

529 plans got a retirement upgrade! Roll over funds to a Roth IRA tax-free.