Several States Are Considering Collecting State Tax on Federal Student Loan Forgiveness

Some states could potentially tax borrowers for forgiven student loan debt

On August 30, 2022, Mississippi became the first state to announce that it will tax borrowers for forgiven student loans. Mississippi borrowers that are making less than $125,000 per year and get $10,000 of student debt forgiveness may owe up to $500 in taxes. If the $10,000 does not cover the entirety of your loan, you could also be on the hook for continuing to pay your monthly payment as well.

Mississippi will not be the last state as tax laws vary from state to state. Many states are currently reviewing their treatment of the federal tax codes.

With the relief coming from the federal government, this leaves the tax up to the state and if they follow the federal treatment of taxes or will they make an exception for the forgiveness handout.

The American Rescue Plan Act 2021 (ARPA)

The forgiveness of student loan debt is considered to be federally tax-free through 2025 Under section 9675 the American Rescue Plan Act 2021 (ARPA). Some states follow the federal treatment and will also exclude the debt forgiveness from their own state income taxes. Not every state does this and some will need to update their own treatment of the Internal Revenue Code.

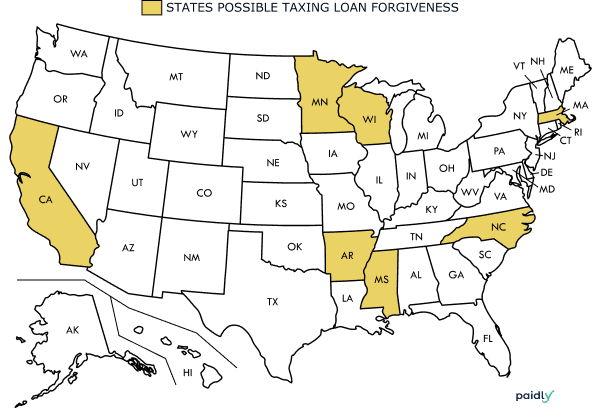

States that already announced they are planning to tax the relief

States that have already announced to tax residents’ forgiven student loan debt and it will be considered income and taxed:

- Mississippi [1] - 5% - $500

States that are still reviewing their tax codes and possibly could tax the debt cancellation

Currently there are still a few States that are reviewing their tax code and whether they are going to tax forgiveness as income tax.

- Arkansas

- Wisconsin

- Massachusetts

- North Carolina

- Minnesota

- California [4]

In Massachusetts, where borrowers could be required to pay $500 in taxes on their debt relief, Governor Charlie Baker suggested that the state plans to follow federal policy. “The state, like other states, is waiting for federal guidance in how it’s going to work and once we get the guidance we’ll basically interpret that in terms of existing state law. I don’t know the answer at this point,” he said, according to local station WWLP.

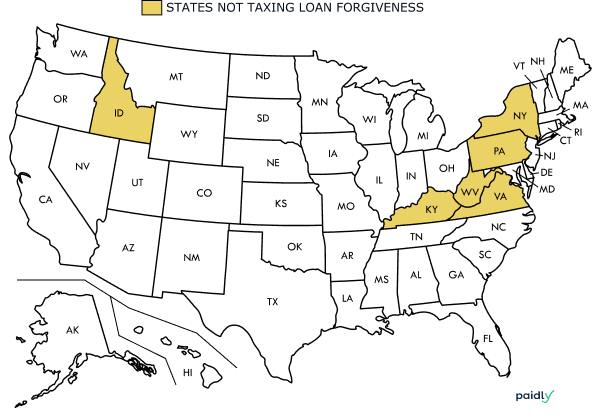

States that have announced they are not planning to tax the forgiveness

Some states have already announced they are not planning to tax borrowers' forgiveness as income.

- New York [2]

- Pennsylvania [3]

- Kentucky

- Virginia

- West Virginia

- Hawaii

- Idaho

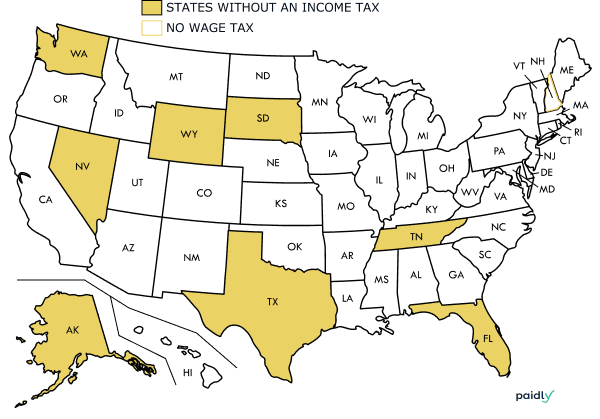

States that currently do not charge income tax

- Washington state

- Nevada

- Wyoming

- South Dekota

- Texas

- Alaska

- Florida

- Tennessee

- New Hampshire (No Wage Tax)

How much income tax on forgiveness could I pay if my state is planning to collect tax?

As a borrower receiving federal forgiveness and live in the one of the states planning to tax the forgiveness as income tax, here is a list of the maximum likely taxes you would expect to pay per state if receiving the full $10,000:

Based on the 2022 Tax Rates

- Arkansas - 5.5% - $550

- Wisconsin - 7.65% - $765

- California - 8% - $800

- Massachusetts - 5% - $500

- Mississippi - 5% - $500

- South Carolina - 7% - $700

What does “Up to $10,000” mean in forgivenness?

In the wording of student loan forgiveness the phrase “up to” 10,000 and “up to” 20,000 has been mentioned, what does this mean? Is there a chance you will not see a complete forgiveness benefit?

No, but if what you have remaining on your loan is less than the benefit you receive, you will not get the remaining in a check paid out to you. Example if you only have $6,000 left in student loan debt when you receive your forgiveness. $6,000 will be used to pay off your debt, while $4,000 will not become a check written to you but will remain with the federal government. In a state that collects this relief as income tax, you will have to pay your state's income tax on the amount you received.

What does this mean for student loan benefits (SLB) like Paidly?

Currently under the CARES Act section 127 if you are receiving a student loan repayment benefit like Paidly from your employer through a 127 tax plan, those payments are still tax-free up to $5,250. But any debt relief you receive from the cancellation will depend on which state you are currently paying taxes in.

Key Takeaways

- Student Loan Repayment Benefits (SLRB) are still tax free up to the $5,250 per employee

- You will only be taxed on the amount you received based on the upto $10,000 to $20,000

- Not every state will tax the debt forgiveness as income tax

Sources

[1]"Mississippi is the first state to confirm it will tax forgiven student loan debt", Business insider https://www.businessinsider.com/mississippi-tax-forgiven-student-loan-debt-13-states-may-follow-2022-8

[2]"The NYS Department of Taxation and Finance", the Gothamist https://gothamist.com/news/no-ny-wont-be-taxing-the-forgiven-debt-on-your-federal-student-loans

[3]revenue-pa.custhelp, Pennsylvania

[4]"States That Might Tax Student Loan Debt Cancellation", Tax Foundation https://taxfoundation.org/student-loan-debt-cancelation-tax-treatment/

Team Paidly

Paidly is a Student Loan Repayment Benefit platform. Leveraging over a decade and a half of Fintech, student loan origination, and refinancing experience. Paidly specializes in creating custom student loan repayment benefit plans, designed specifically to allow employers to pay directly towards their employees' student loans. Paidly's system requires no integration and enhances talent attraction and employee retention.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.