How to Ask Your Employer for a Student Loan Repayment Benefit: A Step-by-Step Guide

Get the Support You Need to Pay Off Your Student Loans: A Step-by-Step Guide to Asking Your Employer for a Tax-Free Repayment Benefit

Key Takeaways

- Understand the basics and research your company's stance on student loan repayment benefits: Know what a student loan repayment benefit is, how it works, and research your employer's current offerings and industry standards.

- Build a strong case for the benefit by showcasing its value for both employees and the company: Highlight the benefits of offering a student loan repayment program, such as attracting and retaining top talent, improving employee retention, and encouraging participation in retirement plans.

- Explore alternative options and be prepared to negotiate: If your employer isn't currently interested in offering a student loan repayment benefit, investigate other possibilities within their existing benefits packages or suggest alternatives that could provide similar support.

No matter how you feel about the student loan debt crisis, it's a big problem that isn't going away. In fact, student loans have become an enormous problem for many young professionals. In fact, it's not uncommon for new graduates to leave college with more than $100,000 worth of student loans. That's a huge amount of money that can keep you from being able to afford things like buying your first home or starting a family.

Of course, this is where employers come in, they're going to be providing health insurance and retirement benefits for you as long as you work at their company—so why shouldn't they also help with your student loans?

If your company doesn't offer a repayment benefit that helps employees pay back their student loans (like paying a small percentage), then this guide will show you how to convince them that offering one would be good, not just for employees, but also for the business itself.

Step 1: Know the basics

Before you reach out to your employer, it's important to understand what a student loan repayment benefit is and how it works. It’s also a good idea to build a case for the benefit to show the value to the employee and the company.

The first thing to know is that not all companies offer this kind of benefit. If yours does, great! If not, there are still ways you can get help paying off your loans, so don't give up hope just yet!

A student loan repayment benefit allows an employee, with qualifying loans, to receive supplemental payments from their employer. To clarify, these employer payments are “supplemental” payments. The employee must continue to make their monthly student loan payment.

Read about the different types of student loan repayment benefits on our blog post. it’s important to understand the options before you propose the idea of a benefit.

Step 2: Research to determine whether your employer would consider this type of benefit.

-

Talk to your manager. Your first step should always be talking with your boss, who will be able to tell you whether the company would even consider this kind of benefit.

-

Check HR's website or benefits page. If they don't mention student loan repayment in their current offerings, ask why that is and if there's any chance it could be added sometime soon (or even retroactively). They may also have suggestions from other companies that offer similar benefits and if so, those can be great places for you to look next!

-

Look at industry standards for benefits packages: In general and see where your company stands compared with others in the same field; then compare its offerings against those at other companies within the same field or industry space as well as outside of it (if applicable).

Step 3: Make a case for this Student Loan repayment benefit

It's time to convince them that it will help their business by creating a case.

Here are some of the reasons:

-

Attracting and retaining talent: Student loan repayment is becoming an increasingly competitive benefit among employers, especially for younger workers who are saddled with debt and looking for ways to manage their finances. Offering this benefit can help attract top talent and keep them happy at work. A happy employee can be more productive than one who isn't getting what they need out of their job (or feels stuck in a rut).

-

Employee retention: Many people leave their jobs because they can't afford to stay financially stable while working there anymore. If your company offers student loan repayment benefits, then employees may feel more secure about staying on board longer term.

-

Ability to contribute to retirement: an un-indebted employee might be able to contribute 10% to a plan and earn 5% employer match for a total of 15%, an employee with student loan debt may only be able to get the 5% match and unable to participant in company 401(k) plans until much later in their career.

Step 4: If the company can't offer the exact benefit you want, maybe they'll entertain other ideas.

If a student loan repayment benefit isn't on their radar, but they have an employee assistance program (EAP), see if there's anything similar in it. You might be able to negotiate for something like that instead of asking for something brand new and different.

It's also worth noting here that just because your employer isn't offering a student loan repayment benefit doesn't mean it won't ever happen, it just means that right now isn't the right time for them to do so. Perhaps if enough employees express interest in such a benefit, management will reconsider their position over time and decide to implement one at some point in the future!

Keep in mind that you're asking your employer for something that would change their business model and cost them money.

Employers may not be as likely to pay for something that they can't see value in or that they feel will not help grow the business.

That said, there are some benefits an employer can get from offering this kind of benefit:

- It makes the company more competitive when recruiting top talent (especially if other companies have similar programs).

- It helps attract employees who value education over salary and those people are more likely to stay with your company long term.

- It can be a tax-free benefit up to $5250 a year until 2025 under the CARES Act.

- Unused Paid Time Off (PTO) or PTO Buyback as well as bonuses can be redirected to employees student loans to help fund this benefit.

It can help retain valuable employees who are considering leaving for other companies. It's a way to show your employees that you care about them and their success.

They may not be able to give you everything you want on day one, but they may be willing to work with you to create a new benefit.

Answering some of the basic questions around the Student Loan Repayment benefit will help your company gain a better understanding of the benefit. They can use the general information that you share to do some research of their own.

Paidly offers the following options that scale to the business:

-

3 types of Student Loan Repayment benefits:

- Recurring - monthly

- $250 one-time set up fee per company per benefit.

- Starter Plan: $7 per user per benefit when enrolling up to 25 employees

- Professional Plan: $6 per user per benefit when enrolling up to 26-100 employees

- Enterprise Plan: customized pricing for over 100 users (unlimited users)

- On-demand - one-time payment on company’s schedule

- Bonus/PTO Conversion - converting a bonus or “leftover” PTO into a student loan repayment benefit

- Recurring - monthly

-

What are the benefits to Employees:

- Debt-free future

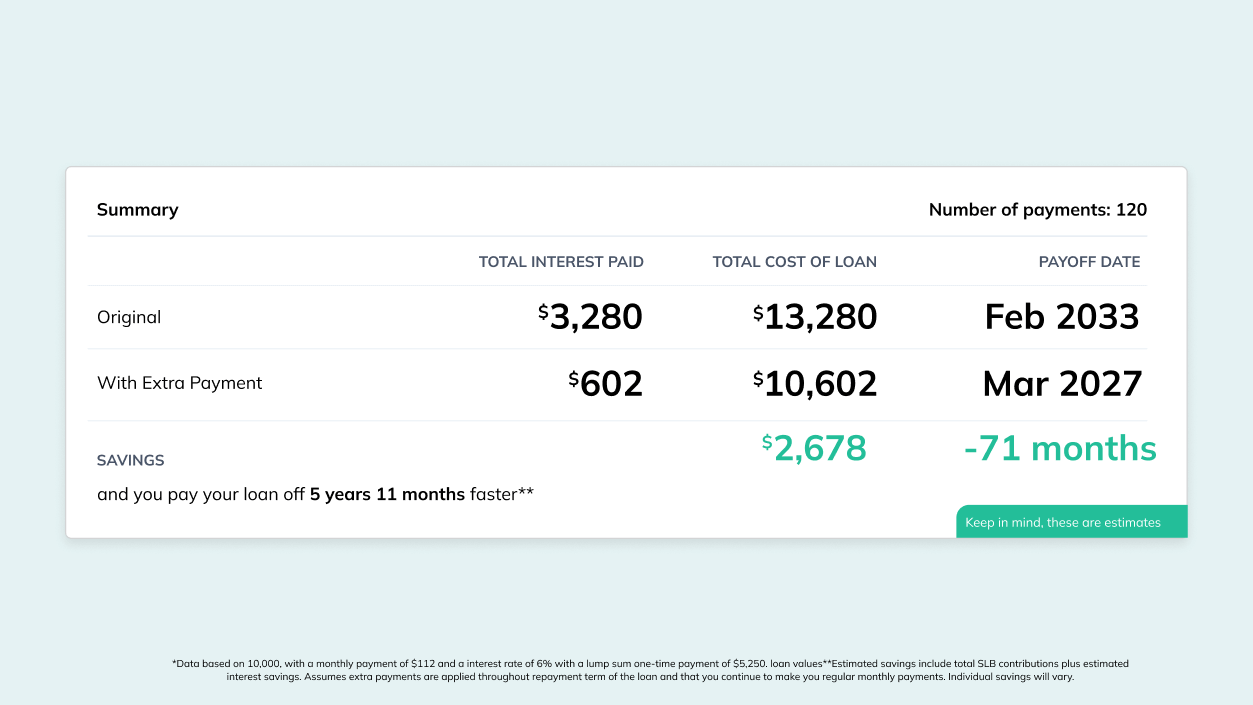

- Reduce loan payback & interest dollars

- Reduce financial stress & distraction

- Increase energy & resources for building new skills and careers

- Improve financial preparedness for retirement

- Supplemental, tax-free monthly payments towards employee student loans

-

What are the benefits to the Employer:

- Become an employer of choice

- Maintain a competitive advantage in a tight labor market

- Offer cultural & employee benefit differentiation

- Enhance recruitment efficiency - increase the talent pool for a particular specialty

- Enhance employee retention - reduce turnover for experienced employees

- Improve the financial wellness of employees beyond retirement benefits - reduce financial stress on current/future workforce

- Improved employee productivity through stress reduction due to student loan debt

This is an employee-driven benefit, so it's up to employees like you to convince HR that it's a good idea.

It's important that you come prepared with all the information you've gathered. Present the information in an organized manner and make sure they can easily access it. Include details about the ROI the company can gain by offering this benefit, as well as how much time and money you will save by repaying your loans sooner. You may also want to include:

- Some key points around the CARES Act and the tax-free possibilities of this benefit.

You got this

Asking your employer for a student loan repayment benefit might seem like a tall order, but it's not impossible. You just need to know where to start and how best to communicate with HR. The most important thing is that you have a plan in place before making any contact with your company.!

Team Paidly

Paidly is a Student Loan Repayment Benefit platform. Leveraging over a decade and a half of Fintech, student loan origination, and refinancing experience. Paidly specializes in creating custom student loan repayment benefit plans, designed specifically to allow employers to pay directly towards their employees' student loans. Paidly's system requires no integration and enhances talent attraction and employee retention.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.