Navigating Public Service Loan Forgiveness

You might have heard that some student loans are eligible for public service loan forgiveness or PSLF, but what does that mean? What jobs qualify, and how do you apply?

Key Takeaways

- Understand what Public Service Loan Forgiveness (PSLF) is and its eligibility criteria

- Learn about the PSLF Waiver and the role of the income-driven repayment plan

- Explore qualifying jobs for PSLF and compare PSLF, IDR, and ICR

- Consider additional avenues for alleviating the stress of student loan debt with employer supported student loan repayment programs

Public Service Loan Forgiveness or PSLF for short, is not the same as Biden’s Student Loan Forgiveness plan that recently was blocked in the supreme court. The PSLF program was established long before President Biden's term and is structured to forgive the remaining balance on Direct Loans after making 120 qualifying monthly payments under a qualifying repayment plan, while working full-time for a qualifying employer.

While both these plans aim to provide relief to student loan borrowers, they differ substantially in their terms and conditions, eligibility, forgiveness amounts, and implementation process.

What is Public Service Loan Forgiveness or PSLF?

Public service loan forgiveness (PSLF) is a federal program that forgives the remaining balance of your federal student loans after you make 120 monthly payments on an Income-driven repayment plan (IDR), an IDR plan is not required but is recommended for most borrowers. The program is designed to help borrowers who have made regular payments on their student loans for at least 10 years.

The goal of PSLF is to allow people who are working in public service jobs, like teachers, firefighters and police officers, to get out from under their debt burden by paying off their remaining balances through monthly deductions from their paychecks (after allowing for taxes).

When do you qualify for PSLF?

A public service loan forgiveness program is only available if you are a full-time employee of a qualifying employer and meet certain other requirements.

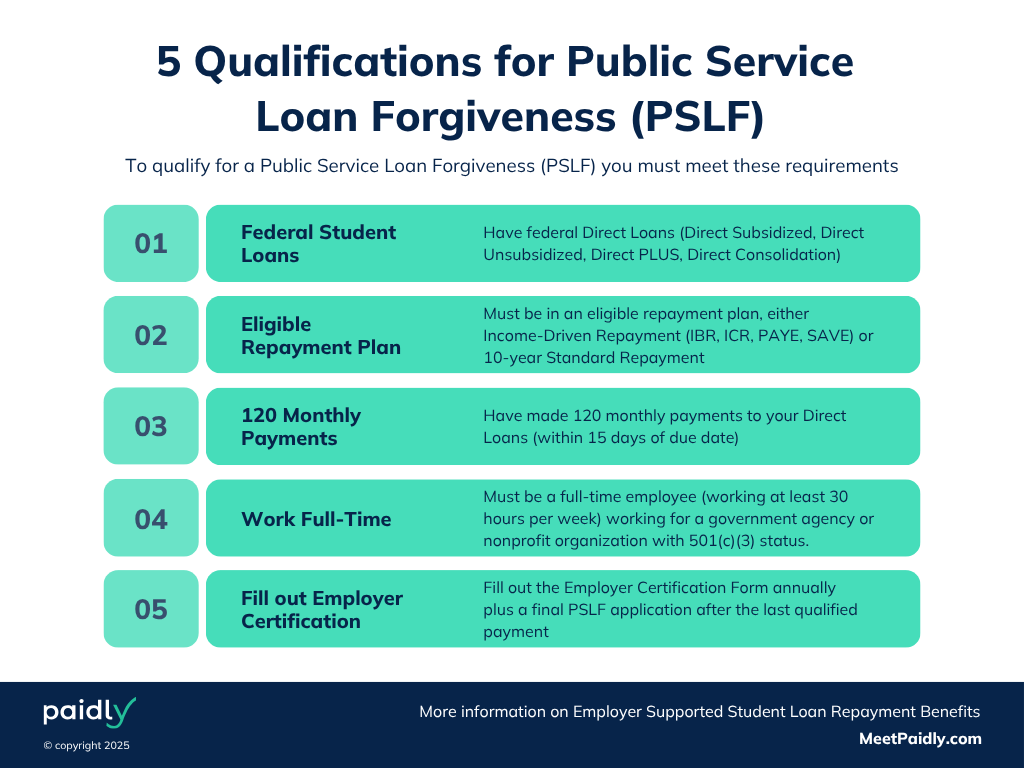

To qualify for one of these programs, you must:

- Obtain eligible federal student loans (specifically, Direct Loans)

- Be a full-time employee (working at least 30 hours per week) and work for a qualifying employer (government organizations, non-profit organizations, or other qualifying public service jobs)

- Have made 120 monthly payments on your Direct Loans under an income-driven repayment plan (IDR).

- Have borrowed at least $50,000 in federal student loans through the Federal Family Education Loan (FFEL) program or Direct Loan Program.

How do I know if I have FFELP Loans?

In case you possess federal student loans issued in 2010 or prior, chances are high that they fall under the FFELP category. A portion of these outstanding FFELP loans remain under the control of the federal government, known as ED-held FFELP loans, while the majority continue to be managed privately by corporations, such as Nelnet.

You can visit studentaid.gov to determine the type of student loan you're dealing with and ascertain if it's under the jurisdiction of the federal government or owned by a private entity. On studentaid.gov you can use your FSA ID to see your loan amount, status, servicer and any outstanding balance.

What Jobs Qualify for PSLF?

Jobs that typically qualify for PSLF include:

- Government and non-profit jobs. If you work for a government agency or non-profit organization, then the PSLF program is an option for you. This includes teachers (including those who teach at charter schools), law enforcement officers, military personnel, public defenders and prosecutors and other such occupations that are considered to be public service careers.

- Employment in non-profit organizations with 501(c)(3) tax-exempt status

- Other non-profit organizations, not classified as 501(c)(3), that provide specific public services, such as education, health, or public safety

- Private sector employers also offer loan forgiveness programs but they're not as generous as those of the federal government; these include IBM and AmeriCorps National Service programs.

Loan Types Allowed in PSLF

To participate in PSLF, your loans must be in the Direct Loan Program. The eligible loan types include:

- Direct Subsidized Loans: These are loans for undergraduate students with demonstrated financial need, and the interest is paid by the federal government while you are in school and during certain deferment periods.

- Direct Unsubsidized Loans: These loans are available to both undergraduate and graduate students, and the interest accrues while you are in school and during deferment or forbearance.

- Direct PLUS Loans: These loans are available to graduate or professional degree students, as well as parents of dependent undergraduate students. The borrower is responsible for paying all the interest that accrues, and they require a credit check.

- Direct Consolidation Loans: These loans allow you to combine multiple federal student loans into a single loan, simplifying your repayment process. Consolidating non-eligible loans into a Direct Consolidation Loan can make them eligible for PSLF.

It is important to note that loans made under the Federal Family Education Loan (FFEL) Program or private loans are not eligible for PSLF. Only loans in the Direct Loan Program will qualify.

Do I Need to be on an Income-Driven Plan for PSLF Eligibility?

While it's not an absolute requirement to be on an income-driven repayment (IDR) plan to qualify for Public Service Loan Forgiveness (PSLF), we highly recommend IDR plans for most borrowers. These plans take into account your income and family size, providing more budget-friendly monthly payments. Moreover, an IDR plan ensures that your monthly payment contributes towards the required 120 payments for the PSLF program.

Although the 10-year Standard Repayment Plan's payments are considered qualifying, you might find it beneficial to switch to an IDR plan to maximize the PSLF advantages. Ordinarily, the 10-year Standard Repayment Plan results in fully repaying your loans once you've made 120 qualifying PSLF payments, leaving no remaining balance to forgive.

However, if your 120 qualifying payments include periods of approved deferments or forbearances, there may still be a remaining balance eligible for forgiveness.

How do you Apply for PSLF?

To apply for PSLF, you need to submit the Employment Certification Form (ECF) to your student loan servicer. This form asks you to provide proof that you're working in a qualifying public service job and provides information about the employer where you work. Applying for PSLF involves these essential steps:

- Review your loan portfolio to ensure they are eligible Direct Loans

- Ensure your employment qualifies for PSLF by completing and submitting the Employment Certification Form annually and with each employer change

- Choose a qualifying repayment plan (IDR plans are recommended)

- Make the required 120 qualifying monthly payments

- Submit the PSLF application after completing the 120 payments

What is a PSLF Waiver or Limited PSLF Waiver?

The limited PSLF waiver ended on Oct. 31, 2022.

The PSLF Waiver was a temporary expansion of the PSLF program announced in October 2021 by the U.S. Department of Education. This waiver allowed borrowers who were previously ineligible for PSLF due to being in a non-qualifying repayment plan (such as graduated or extended) to receive forgiveness if they meet other PSLF requirements, including making 120 qualifying payments.

A PSLF waiver is a temporary suspension of the program. There are two types:

- A limited PSLF waiver is for people who have already made 10 years of payments and want to continue making them while their application for forgiveness is pending. You can apply for this type of waiver if you were originally enrolled in an eligible repayment plan when you first borrowed, but then switched to another one later on (for example, by consolidating your loans).

- A full PSLF suspension means that your loans will no longer be eligible for forgiveness until the end of 2023--the same year that all existing borrowers will have been making qualifying payments toward forgiveness for 10 years (or more).

As the U.S. Department of Education diligently processes PSLF applications and updates accounts to reflect the limited PSLF waiver credits, they are concurrently implementing changes announced in April 2022 related to a one-time income-driven repayment (IDR) account adjustment.

These positive and empowering adjustments indicate that borrowers with federal loans under management can anticipate a potential increase in their payment count contributions, enhancing their progress towards IDR and PSLF forgiveness in July 2023.

PSLF vs. IDR vs. ICR

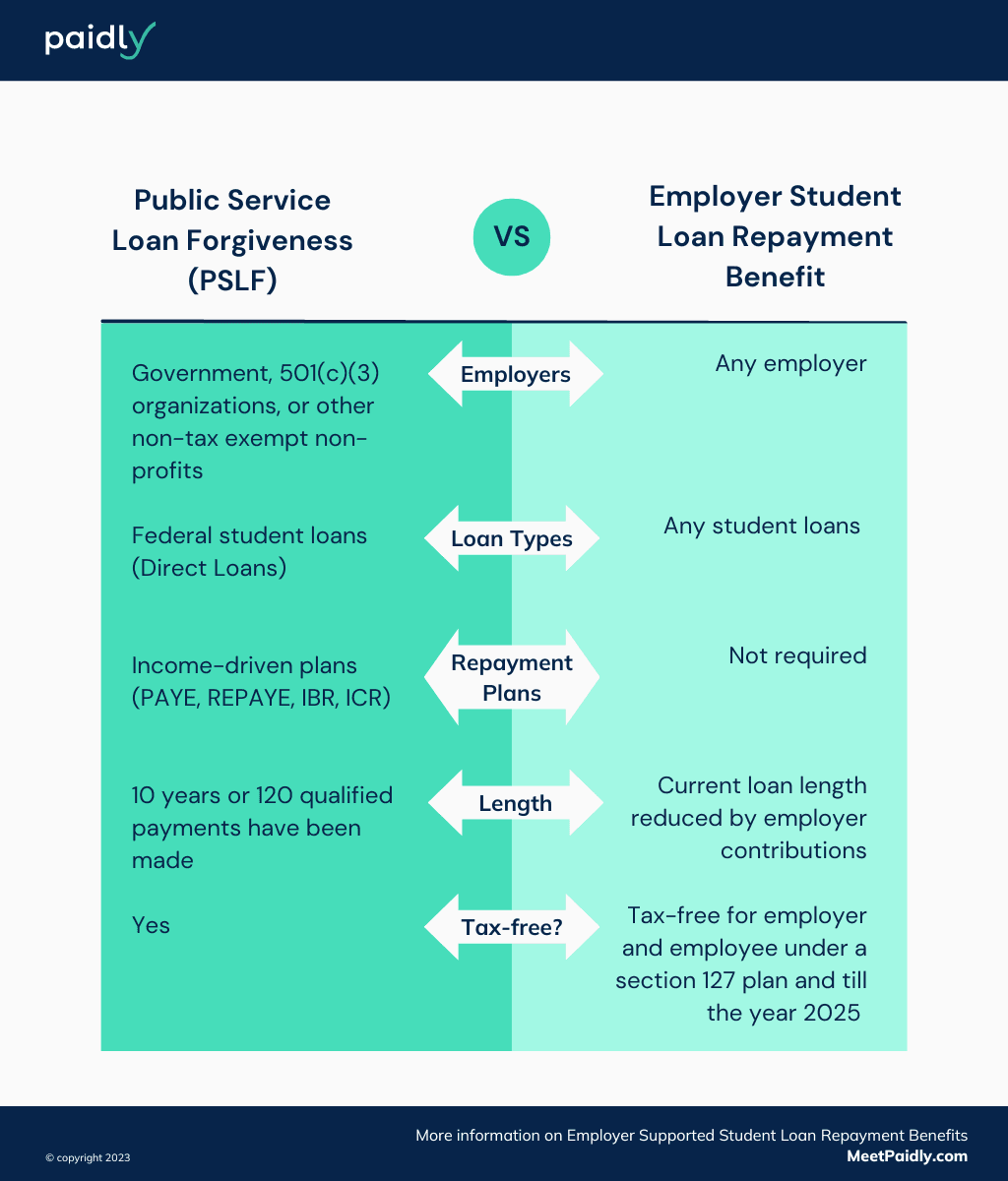

- PSLF (Public Service Loan Forgiveness): A program that forgives the remaining balance of eligible Direct Loans after meeting the requirements, including making 120 qualifying payments while working for a qualifying employer.

- IDR (Income-driven Repayment): An umbrella term for four repayment plans that base your monthly payment on your income and family size, potentially lowering your monthly payments and increasing the timeline for forgiveness.

- ICR (Income-contingent Repayment): One of the income-driven repayment plans, specifically designed for Parent PLUS Loans borrowers and borrowers with significantly lower income compared to their student loan debt.

Forgiveness Options for Teachers (TLF)

This program is best for qualifying teachers who don’t have large amounts of debt, as Teacher Loan Forgiveness (TLF) offers less forgiveness but offers it quicker.

Who Qualifies

Teachers who have taught full time for five consecutive years at a qualifying low-income elementary or secondary school qualify.

- Worked full-time as a qualified teacher for five consecutive years

- At least one of those years must have been after the 1997-1998 academic year.

- The loans you wish to have forgiven must be Federal Direct Subsidized and Unsubsidized Loans or Federal Direct Stafford Loans.

Loan Forgiveness Amounts for TLF?

Secondary math, science and special education teachers can get up to $17,500 forgiven. Elementary school teachers and secondary school teachers who teach other subjects can get up to $5,000 forgiven.

How Do You Apply for TLF?

- Verify that you meet the eligibility requirements

- Submit a completed Teacher Loan Forgiveness Application (TLF) application to your loan servicer.

Maximize Your Benefits with Paidly

In light of exploring the benefits of PSLF, it's crucial to consider additional avenues for alleviating the stress of student loan debt. Paidly offers an innovative solution that bridges the gap between financial freedom and student loan obligations. With a forward-thinking employer, integrating Paidly into employee benefits programs can considerably enhance each team member's student loan repayment experience.

By providing a tax-free supplemental payment of up to $5,250 annually, Paidly not only empowers employees to regain control of their student loans but also significantly eases the financial burden affecting their everyday lives. Embrace this opportunity to drive positive change and inspire confidence in your workforce with Paidly's unique approach. Meet Paidly and lets talk repayment benefits.

Team Paidly

Paidly is a Student Loan Repayment Benefit platform. Leveraging over a decade and a half of Fintech, student loan origination, and refinancing experience. Paidly specializes in creating custom student loan repayment benefit plans, designed specifically to allow employers to pay directly towards their employees' student loans. Paidly's system requires no integration and enhances talent attraction and employee retention.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.