The Hidden Dangers of Income-Based Student Loan Repayment Plans

Discover why income-based repayment plans for student loans may be a wolf in sheep's clothing, and learn how to truly conquer your debt.

Key Takeaways

- Income-based repayment plans can lead to growing loan balances and extended repayment periods, potentially costing borrowers more in the long run.

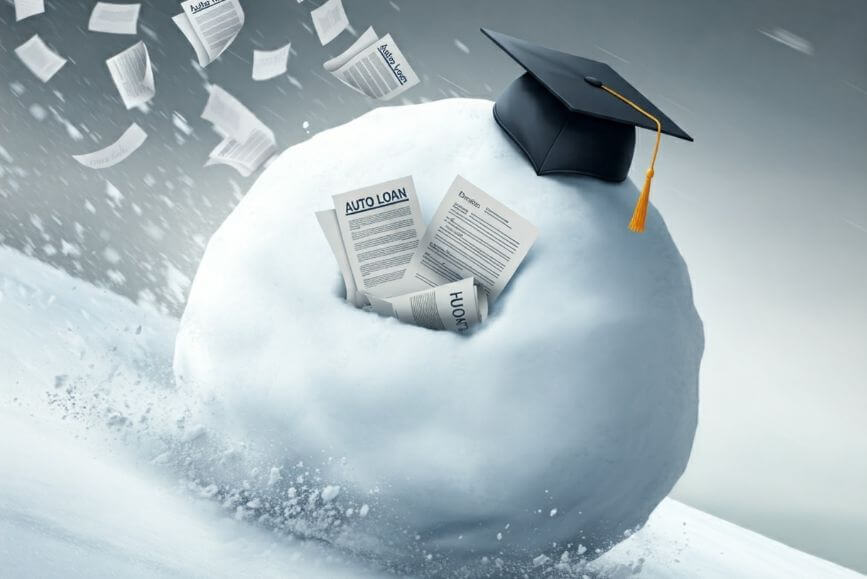

- Minimum payments on student loans often result in a snowball effect, where debt grows faster than it can be repaid.

- Aggressive repayment strategies, such as paying more than the minimum and utilizing the debt snowball method, can help borrowers pay off student loans faster and save on interest.

- Exploring employer benefits, like student loan repayment assistance programs, can provide additional support in tackling student debt more effectively.

At Paidly, We're committed to helping you navigate the complex world of student loan repayment assistance. Today, we're shedding light on a crucial issue that many borrowers face: the potential pitfalls of Income-based repayment plans.

The Illusion of Low Payments

Income-based repayment plans often seem like a lifeline for borrowers struggling with high student loan balances. These plans promise lower monthly payments based on your income, which can feel like a relief. However, this short-term comfort can lead to long-term financial strain.

The Harsh Reality

- Growing balances: Lower payments often don't cover the interest, causing your loan balance to increase over time.

- Extended repayment periods: You might be paying for decades longer than expected.

- Higher total costs: In the long run, you could end up paying significantly more than your original loan amount.

Minimum Payments: The Sneaky Way Your Debt Grows Faster

When you make only minimum payments, especially on high-interest loans, you're barely making a dent in your principal balance. This can lead to an effect where your debt grows faster than you can pay it off.

A Real-Life Example

- Original loan: $80,000

- Payments made over 10 years: $120,000

- Remaining balance: $76,000

This shocking scenario is all too common and demonstrates how minimum payments can keep you trapped in debt. Student Loan Debt Statistics reports that the percentage of borrowers with growing student loan balances has nearly doubled over the last decade, highlighting the widespread nature of this issue.

The Importance of Aggressive Repayment

At Paidly, we advocate for a more proactive approach to student loan repayment. Instead of relying solely on income-based plans, consider strategies that help you pay off your loans faster.

Effective Strategies

- Pay more than the minimum: Whenever possible, pay extra towards your principal balance.

- Use the debt snowball method: Focus on paying off small balances first to build momentum.

- Explore employer benefits: Many companies, like those partnering with Paidly, offer student loan repayment assistance.

Taking Control: The Debt Snowball Method

So, what's the solution? It's time to take control of your student loans with the debt snowball method. Here's how it works:

- List all your debts from smallest to largest

- Make minimum payments on all debts except the smallest

- Throw every extra dollar you can at the smallest debt

- Once the smallest debt is paid off, roll that payment into the next smallest debt

- Repeat until all debts are paid off

Leverage Your Support Network

While aggressive repayment strategies are crucial, don't overlook the power of your support network. Programs like Paidly's Friends Helping Friends (FHF) can accelerate your debt repayment journey.

The Gift of Financial Freedom

Transform birthday and holiday gifts into contributions towards your student loan repayment. Instead of traditional presents, your loved ones can directly impact your financial future.

By combining smart repayment strategies with support from friends and family, you can significantly speed up your path to becoming debt-free. This holiday season, consider asking for the gift that keeps on giving – a lighter student loan burden.

Learn more about how Paidly can help you harness your support network

Team Paidly

Paidly is a Student Loan Repayment Benefit platform. Leveraging over a decade and a half of Fintech, student loan origination, and refinancing experience. Paidly specializes in creating custom student loan repayment benefit plans, designed specifically to allow employers to pay directly towards their employees' student loans. Paidly's system requires no integration and enhances talent attraction and employee retention.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

A Meaningful Gift for the Ones Who Matter Most

Gifting financial freedom is more than a gesture - it’s an investment in those you care about. Help your loved ones thrive by supporting their education this holiday season.

The Gift That Keeps On Giving: 529 Year-End Bonuses

Spread your year-end bonus further this season by paying directly toward employees’ 529 educational savings plans.

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.