The 50-30-20 Rule: How to Budget Your Way Out of Student Loan Debt

Discover how the 50/30/20 rule can be your ally in mastering student loan repayments without the stress.

Key Takeaways

- The 50-30-20 budgeting rule allocates 50% for essentials, 30% for discretionary spending, and 20% for savings/debt repayment - ideal for managing student loans.

- Employer student loan repayment assistance programs help employees pay off debt faster by contributing directly to their outstanding student loans.

- Combining the 50-30-20 rule with an employer's student loan repayment benefit maximizes monthly payments towards eliminating student debt quickly.

- Budgeting effectively and leveraging employer benefits are key strategies for recent graduates to tackle daunting student loan balances responsibly.

When it comes to determining how much you should spend on rent, rigid rules like the 30% or 50/30/20 budget may not always be the best approach, as personal circumstances and priorities can vary significantly.

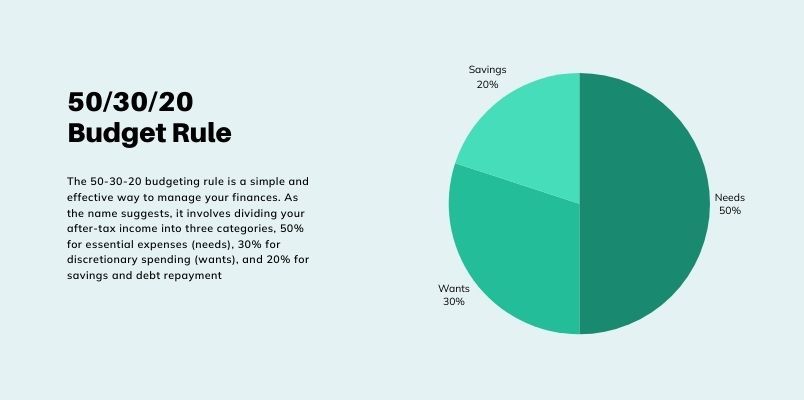

What is the 50/30/20 Budgeting Rule?

The 50/30/20 rule is a popular budgeting strategy that divides your after-tax income into three categories: 50% for essentials or needs, 30% for discretionary spending or wants, and 20% for savings and debt repayment.

Essentials (50%):

- Rent or mortgage payments

- Utilities (electricity, water, gas)

- Groceries

- Transportation costs (gas, car payments, insurance)

- Minimum debt payments

Discretionary Spending (30%):

- Dining out

- Entertainment (movies, concerts, subscriptions)

- Vacations

- Hobbies and leisure activities

- Personal care (haircuts, gym memberships)

Savings and Debt Repayment (20%):

- Emergency fund contributions

- Retirement account contributions

- Extra debt payments (credit cards, student loans)

- Investments

The 50/30/20 rule aims to strike a balance between essential expenses, discretionary spending, and saving or paying down debt. It provides a simple framework for allocating your income and can be adjusted based on individual circumstances.

The Origins and Popularity of the 50/30/20 Rule

The 50/30/20 budgeting rule gained popularity after its introduction in the 2005 book "All Your Worth: The Ultimate Lifetime Money Plan" by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi. The rule provides a straightforward framework for allocating one's income: 50% towards necessities like housing, food, and utilities, 30% towards discretionary spending or "wants," and 20% towards savings and debt repayment.

The simplicity of the 50/30/20 rule has made it an appealing budgeting strategy, especially for those new to financial planning. Its proponents argue that it offers a balanced approach, ensuring that essential expenses are covered while allowing room for enjoyment and future savings. However, critics contend that the rigid percentages may not suit everyone's unique circumstances, particularly those with high housing costs or significant debt burdens.

Applying the 50/30/20 Rule to Student Loan Repayments

The 50/30/20 budgeting rule is a popular framework for managing finances, allocating 50% of your income towards essential needs, 30% towards discretionary wants, and 20% towards savings and debt repayment. When it comes to student loan repayments, the 30% portion can be a useful guideline.

According to CollegeAve.com, the 30% category is meant for flexible spending on non-essential items like dining out, entertainment, and other discretionary expenses. However, this portion can also be allocated towards paying off debts, including student loans.

One strategy is to prioritize student loan repayments within the 30% portion, potentially allocating the entire 30% towards loan payments. This approach can help you make significant progress in reducing your student loan burden, especially if you have a higher income or can temporarily minimize discretionary spending. Additionally, USNews.com suggests that a monthly student loan payment exceeding 10% of your income could be considered a financial burden. By allocating more towards student loans, you can potentially make meaningful progress towards becoming debt-free and save on interest.

When the 50/30/20 Rule May Not Work

The 50/30/20 budget rule is a useful guideline, but it may not be the best approach for everyone's unique financial situation. As Fool.com points out, this rule can be problematic for those with high housing costs, significant debt, or low income levels.

For instance, if you live in an area with a high cost of living, allocating only 50% of your income to necessities like rent, utilities, and transportation may not be feasible. In such cases, you might need to adjust the percentages to accommodate higher housing expenses.

Similarly, if you have a low income or are burdened with substantial debt, strictly adhering to the 30% limit for discretionary spending and the 20% savings target may be unrealistic. You may need to temporarily prioritize debt repayment or essential living expenses over saving or discretionary purchases.

The 50/30/20 rule is a general guideline, and it's essential to tailor it to your specific circumstances. Adjustments may be necessary based on your income level, debt obligations, cost of living, and financial goals. Flexibility and adaptation are key to creating a sustainable budget that works for your unique situation.

What is the 50/30/20 rule with Student Loan Payments

Student loan payments would typically fall under the "Essentials" category in the 50/30/20 budgeting framework, along with other necessary expenses like rent, groceries, and utilities. This means that a significant portion of the 50% allocated for essentials may need to go towards student loan payments, leaving less for other essential costs.

According to NerdWallet, "The 50% category covers needs like housing, groceries, utilities, transportation, insurance and minimum loan payments." This highlights that student loan payments are considered a need and should be prioritized within the essentials category.

For those with substantial student loan debt, this can significantly impact the remaining percentages for wants (30%) and savings (20%). In such cases, one may need to adjust the percentages to allocate a higher portion towards essentials, reducing the wants and savings categories temporarily until the loans are paid off or the burden is reduced.

Employer student loan repayment assistance programs, like Paidly, can be incredibly helpful in this situation. These programs provide a means for employers to contribute towards their employees' student loan payments, effectively reducing the monthly out-of-pocket cost for the employee. This can free up more of the essentials budget for other necessary expenses, or even allow for a higher allocation towards wants and savings while still making progress on loan repayment.

Student Loan Repayment Benefits with Paidly

While the 50/30/20 rule offers a simple budgeting heuristic, it fails to address the nuanced financial situations everyone faces. By establishing a personalized budget that reflects your financial reality and goals, you can make informed decisions about renting that support your overall financial wellbeing.

Considering employer student loan repayment benefits as a way to adjust your budget? This could be a strategic move to reduce monthly expenses, allowing a better allocation towards rent or savings. An individual's journey to managing finances might be complex, but with the right approach, finding a balance that accommodates a comfortable living situation becomes achievable.

Paidly allows employers to contribute up to $5,250 per year tax-free towards their employees' student loans as a supplemental benefit. By taking advantage of this employer student loan repayment assistance, you can effectively increase your discretionary income and savings rate without having to make major lifestyle changes. It's a win-win for employees looking to get out of debt faster while maintaining their current standard of living.

Team Paidly

Paidly is a Student Loan Repayment Benefit platform. Leveraging over a decade and a half of Fintech, student loan origination, and refinancing experience. Paidly specializes in creating custom student loan repayment benefit plans, designed specifically to allow employers to pay directly towards their employees' student loans. Paidly's system requires no integration and enhances talent attraction and employee retention.

Join our newsletter

Don't miss any more news and subscribe to our newsletter today.

The information provided is of a general nature and an educational resource. It is not intended to provide advice or address the situation of any particular individual or entity. Any recipient shall be responsible for the use to which it puts this document. Paidly shall have no liability for the information provided. While care has been taken to produce this document, Paidly does not warrant, represent or guarantee the completeness, accuracy, adequacy, or fitness with respect to the information contained in this document. The information provided does not reflect new circumstances, or additional regulatory and legal changes. The issues addressed may have legal, financial, and health implications, and we recommend you speak to your legal, financial, and health advisors before acting on any of the information provided.

You may also like

Why You’ll Want to Put Year-End Bonuses Toward Student Loans

Putting employee year-end bonuses directly toward student loans is the perfect way to strengthen your workforce this holiday season.

529 to Roth IRA Rollovers: A New Path to Retirement Savings

529 plans got a retirement upgrade! Roll over funds to a Roth IRA tax-free.

The Hidden Dangers of Income-Based Student Loan Repayment Plans

Discover why income-based repayment plans for student loans may be a wolf in sheep's clothing, and learn how to truly conquer your debt.